“After years of selling their stocks of gold, central banks around the world are now buying bullion, according to a new study on the “Seven Ages of Gold.”

Source: Central banks have been buying gold with a vengeance

“After years of selling their stocks of gold, central banks around the world are now buying bullion, according to a new study on the “Seven Ages of Gold.”

Source: Central banks have been buying gold with a vengeance

The Fed’s easy money policies always ends in a bust…the sooner the better.

Source: America Needs an Old-Fashioned Depression

I spent this morning with three of my colleagues visiting the American Museum of Finance on Wall Street, down the street from the NYSE, the Trump building and a couple of blocks form the New York Fed. Last week I joined the AMOF and will organize a trip in September for my Financial History of the US course. I urge you to join at www.moaf.org

Below are some pictures I took inside the museum. If you will be visiting NYC, I highly recommend spending some time viewing the exhibits, which show how American finance was instrumental in creating our prosperity.

“Max Keiser Financial War Reports”

Source: [KR940] Keiser Report: Gold & World’s Debt Problems | Max Keiser

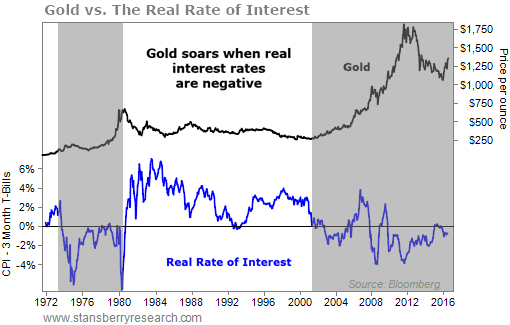

Gold is in the second major bull market since President Nixon severed the last link between the dollar and gold on August 1971. With negative interest rates around the world and real interest rates negative, gold will boom, again.

Gold is in the second major bull market since President Nixon severed the last link between the dollar and gold on August 1971. With negative interest rates around the world and real interest rates negative, gold will boom, again.

In the 1980s and 1990s real interest rates were positive and stock markets were booming, hence gold went nowhere. That alla chnged at the turn of the century.

Greenspan is reverting to his 1966 analysis, Gold and Economic Freedom.

“We’re dealing now in very early days a crisis which has got a way to go. If we went back on the gold standard and we adhered to the actual structure of the gold standard as it exited prior to 1913, we’d be fine. Remember that the period 1870 to 1913 was one of the most aggressive periods economically that we’ve had in the United States, and that was a golden period of the gold standard.”

Source: Greenspan Warns A Crisis Is Imminent, Urges A Return To The Gold Standard