“Kitco News’ general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices.”

Source: Economic Panel Sees Potential For Gold, ‘Helicopter Money’ Coming Soon

“Kitco News’ general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices.”

Source: Economic Panel Sees Potential For Gold, ‘Helicopter Money’ Coming Soon

“Monopoly products and services go up in price, while competitive ones go down.”

Source: Why Luxury TVs Are Affordable when Basic Health Care Is Not | Foundation for Economic Education

The Fed’s easy money policies always ends in a bust…the sooner the better.

Source: America Needs an Old-Fashioned Depression

“Six Major Events That Will Change History By Egon von Greyerz Investors globally have never faced risk of the magnitude that the we are now exposed to. But sadly very few are aware of the un…”

Source: Six Major Events That Will Change History | GoldSwitzerland

“Max Keiser Financial War Reports”

Source: [KR940] Keiser Report: Gold & World’s Debt Problems | Max Keiser

“One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical. But, in certain economies, this…”

Source: Destination Mars | Economic Prism

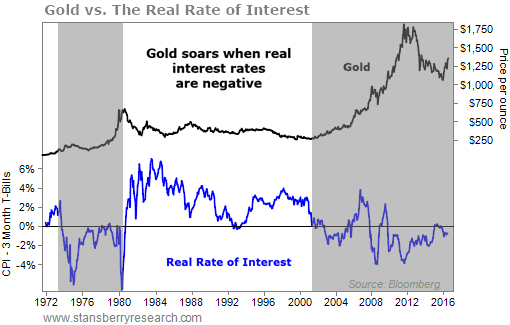

Gold is in the second major bull market since President Nixon severed the last link between the dollar and gold on August 1971. With negative interest rates around the world and real interest rates negative, gold will boom, again.

Gold is in the second major bull market since President Nixon severed the last link between the dollar and gold on August 1971. With negative interest rates around the world and real interest rates negative, gold will boom, again.

In the 1980s and 1990s real interest rates were positive and stock markets were booming, hence gold went nowhere. That alla chnged at the turn of the century.

Will all the Federal Reserve’s money printing lead to big collapse?

Source: Get Ready for Dollar Destruction and the End Game

Price inflation is accelerating. Easy money–quantitative easing–is having its effects on prices.

“The Labor Department said Thursday its producer price index for final demand rose 0.5 percent in June, versus analysts’ expectations of 0.3 percent.”

Source: US Producer Price Index up 0.5% in June vs. 0.3% increase expected

Precious metals prices will soar.

“We’re always assessing tools that we could use,” Mester told the ABC’s AM program. “In the US we’ve done quantitative easing and I think that’s proven to be useful. “So it’s my view that [helicopter money] would be sort of the next step if we ever found ourselves in a situation where we wanted to be more accommodative.

Source: Fed’s Mester Says Helicopter Money “The Next Step” In US Monetary Policy